Worse Before Better

- Juan Patag

- Aug 20, 2025

- 7 min read

1H2025 Residential Property Market Report

August 20, 2025

Disclaimer: This report was prepared by Juan Alfredo Patag in his personal capacity as an independent market analyst. The views and opinions expressed herein are solely those of the author and do not necessarily reflect the official policy or position of RE/MAX Capital, any RE/MAX franchise. This publication is intended for informational purposes only and should not be construed as investment, legal, or tax advice. While every effort has been made to ensure the accuracy of information contained herein, no representation or warranty, express or implied, is given as to its completeness or correctness. Neither the author nor any RE/MAX entity shall be liable for any losses or damages arising from reliance on this report. Developers, brokers, buyers, and other stakeholders are advised to conduct their own due diligence before making business or investment decisions.

Download the PDF version below.

How’s the market doing?

In Connecting the Dots (2024), I noted that without a catalyst to re-ignite demand, most segments would likely remain flat, with only select luxury and prime areas seeing gains. 1H2025 confirms that view.

If you ask brokers active in the greater Metro Manila area, the answer is unanimous: it has become noticeably harder to sell.

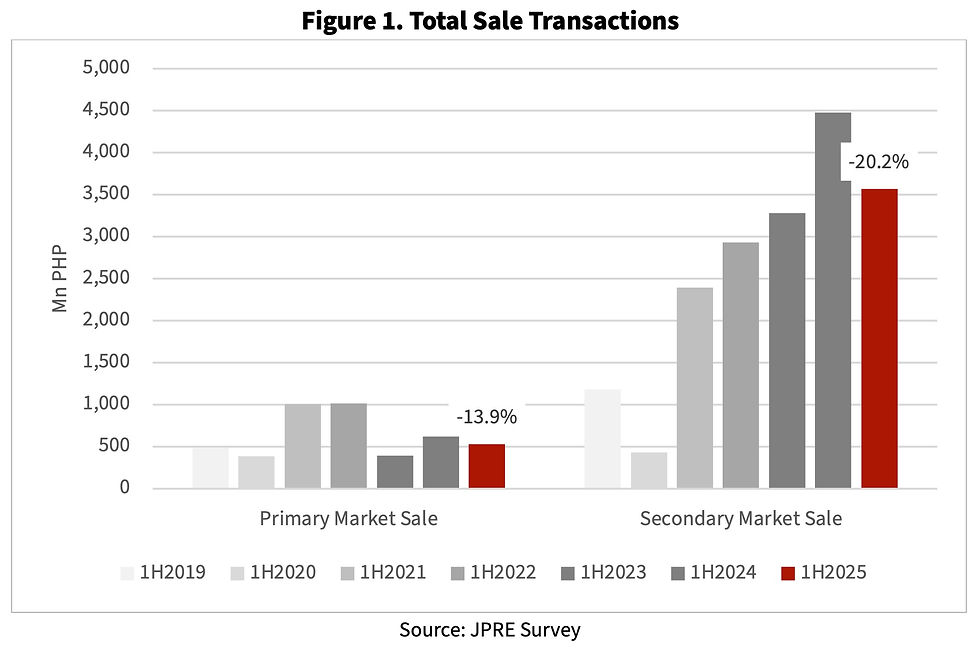

Our survey numbers back this up. Sales activity across both primary and secondary markets dropped, with total transaction value down 19.4% in 1H2025 vs. 1H2024[1]. The Secondary Market bore the brunt of the decline (-20.2%)1, while the Primary Market dipped a bit less (-13.9%)[1].

Which price segments are taking the biggest hit?

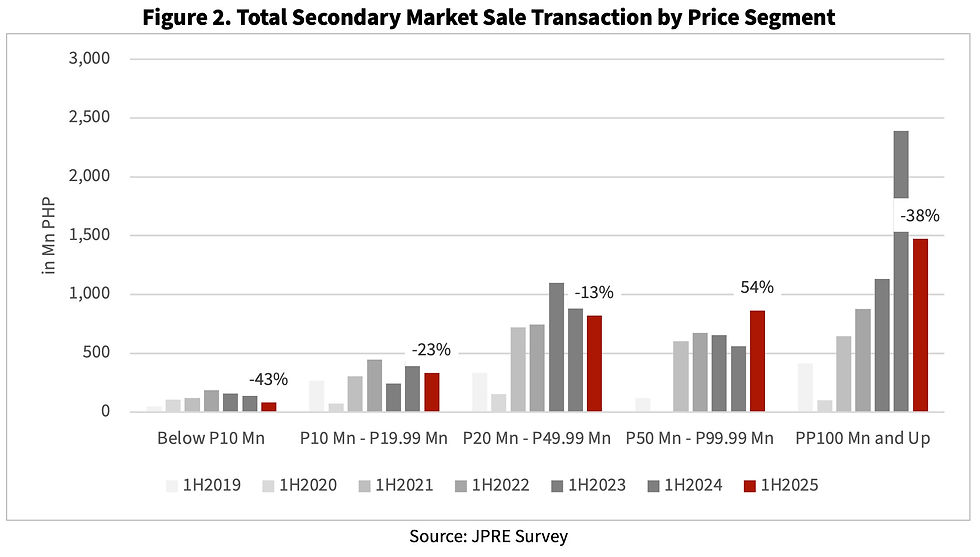

Two extremes in the Secondary Market suffered the sharpest pullbacks:

High-value properties (>Php100 Mn) – Sales in this tier fell 38.4% in peso terms[1]. Transaction count dropped 43%, as the average price per sqm jumped 24%—pricing out many buyers. All deals here were for horizontal properties in prestige enclaves such as Loyola Grand Villas (Php142K/sqm)[2], White Plains (Php243K/sqm)[2], McKinley West (Php410K/sqm)[2], North Greenhills (Php433K/sqm)[2], and Corinthian Gardens (Php480K/sqm)[2]. Not a single Php100 Mn-plus condo changed hands based on the survey conducted.

Below Php10 Mn – Volume collapsed by 43%, suggesting even entry-level buyers are struggling with affordability.

Any bright spots?

Yes—properties in the Php50 Mn to Php99.9 Mn range.

This segment saw a 53.7% jump in sales value in 1H2025 year-on-year, with both transaction count (+30%) and average deal size (+7%) contributing to growth. Many of these were–completed–luxury condos (Proscenium, West Gallery Place, Garden Towers, Pacific Plaza Towers) and “next level” village lots in St. Ignatius, Ayala Southvale Sonera, San Miguel Village, Capitol Hills Golf, which serve as more attainable alternatives to their ultra-prime neighbors.

Interestingly, both condo and lot sizes in this bracket are trending smaller—condos averaged 171 sqm vs. 190 sqm last year, while lot sizes shrank from 449 sqm to 318 sqm.

What’s causing the slowdown?

Buyers and sellers remain in a standoff:

Buyers—especially investors—are bottom fishing, sending in low offers. Even when they find a good deal, many keep searching for something better, which lengthens the sale process.

Sellers—particularly flippers—won’t sell at a loss. While others resist lowering prices further, believing that once they’ve priced below zonal value, they’re already offering a fantastic deal.

Some deals are closing well below zonal value, but not in volumes large enough to meaningfully reduce secondary market inventory. Most transactions today are for end-use rather than speculation, unlike in previous years.

With sales down, are prices dropping?

Not quite.

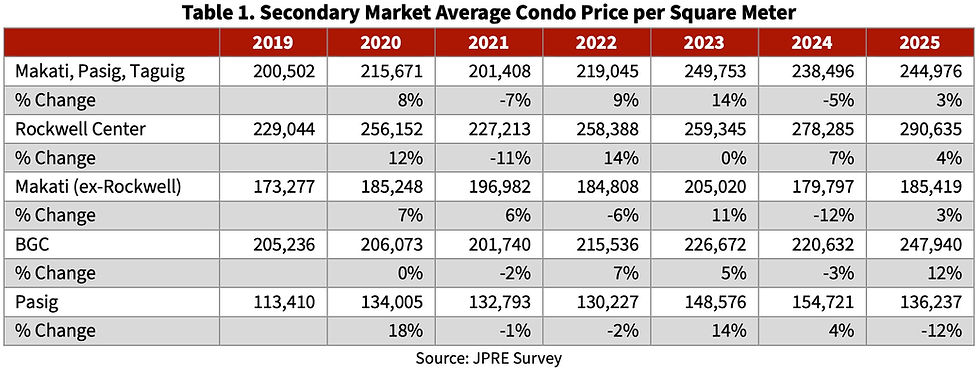

The average price per sqm across core districts stayed broadly flat—with one exception: Bonifacio Global City (BGC), where prices rose 12% on sustained demand in select high-end projects (e.g., West Gallery Place)[2]. Elsewhere, movements were modestly positive or slightly negative—a sideways market at best.

Candlestick charts show that while maximum recorded prices are slipping in many areas, average prices are holding steady—again, BGC is the notable outlier.

That said, BGC’s average is being propped up by one project: West Gallery Place, launched in 2015 and completed in 2021. If this development were excluded, the average BGC price per sqm would have actually declined by about 3%[3].

If the market is slowing, why aren’t prices correcting?

Prices remain sticky because:

Many owners have holding power and can afford to wait.

There’s limited distress selling; no liquidity shock is forcing fire sales.

Bank metrics (NPL ratios, past-due receivables) remain stable.

Even so, one risk I flagged in 2024 is moving closer: a wave of high-end and ultra-high-end condo turnovers in the next three years. Many were sold post-COVID on light payment terms to buyers who may have planned to flip. If they can’t settle the balance at turnover, we could see forced listings.

One ultra-luxury project (units >Php100 Mn) is turning over now, and several buyers have reportedly asked for payment extensions—requests that are being granted.

Possible scenarios if balances remain unpaid:

Contract cancellation under the Maceda Law – Buyers recover 50% of total payments, straining developer cash flow and adding unsold units back to inventory.

Large take-out loans – Buyers borrow to cover the 80% balance, multiplying monthly payments fivefold plus interest—if banks are even willing to finance that many ultra-high-end condos.

Extended payment arrangements – Developers may continue rolling the balance forward until buyers can raise the funds. In fact, some are already offering 10-year payment terms on pre-selling projects—a similar strategy to keep deals alive.

What could push prices down?

A widespread liquidity crunch—potentially triggered by developers’ difficulty in collecting balances—or a broader financial crisis could turn today’s stall into a full correction. Absent such shocks, the market is likely to remain in this holding pattern.

For instance, there are reports of ultra-high-priced build-and-sell houses in the South—listed at over Php200 Mn each—remaining unsold[4]. While it’s unclear how large this segment is, if such projects were heavily debt-funded, some mid-tier developers could face repayment risks.

Will BSP rate cuts help?

Not necessarily. Mortgage rates track PH government securities yields, not directly the BSP’s policy rate. If US rates stay high, GS yields here will remain elevated, keeping bank lending costs—and thus mortgage rates—up.

For example, the Bureau of the Treasury sold 5-year Retail Treasury Bonds on August 15, 2025, with a coupon rate of 6%[5]. Since this represents the 5-year “risk-free rate,” banks would logically price their home loan rates above this level, not below it.

This dynamic was clear in June: after the BSP cut rates, the peso weakened from 55 to 57 as investors saw the move narrowing the PH-US interest rate gap[6].

Other Headwinds and Tailwinds

One potential tailwind for the economy is a tourism boom. San Miguel is set to partially complete its Bulacan airport by 2028, while the Metro Manila Subway could ease commute times and stimulate economic activity. Both projects could unlock new demand in surrounding areas and improve overall market confidence.

On the headwind side, the Real Property Valuation and Assessment Reform Act (RPVARA) will raise property holding costs by updating and standardizing land valuations for real property tax purposes. While the Department of Finance recommends capping annual increases at 6% in the first year, local governments in central business districts could push rates higher in succeeding years[7]. This may pressure some owners to sell—potentially adding more supply to the market and weighing on prices.

Where does that leave us?

1H2025 confirms what many brokers have sensed for a while: the market may get worse before it gets better. The quick-flip era is behind us, and real demand is now skewed toward end-use, not speculative gains. At the same time, buyers and sellers remain locked in a standoff—buyers fishing for bargains while sellers resist dropping prices below zonal values—prolonging the slowdown.

The 1H2025 numbers also validate my 2024 call:

The era of quick flips is over. With prices flat, flippers can no longer count on selling at a profit.

Demand is concentrated in end-use.

Absent any catalyst to re-ignite demand, the market will remain sluggish until incomes catch up.

Still, selective demand exists. For instance, Megaworld’s New Manila horizontal project, priced at Php300,000 to Php350,000 per sqm (high by Quezon City standards), reportedly gathered enough LOIs to sell out[8]—proof that buyers still have cash when a project is positioned as scarce and desirable.

This isn’t all bad—it’s a correction that tempers expectations, stabilizes values, and allows incomes to catch up with prices. As I wrote last year, if you’re buying for the long term (10–15 years) and choose quality assets from reputable developers, even today’s prices could look attractive down the road.

What does this mean for Sellers?

If you urgently need to raise cash and your property isn’t selling, adding more brokers (assuming they’re competent) likely won’t move the needle. Instead, consider making a meaningful price reduction. If a buyer comes in with a low offer, don’t take it personally—use it as a starting point for negotiation. You might find common ground. After all, there’s a reason it’s called a buyer’s market.

What does this mean for Buyers?

With so much supply on the market, it’s easy to get overwhelmed—too many choices can lead to decision paralysis. To cut through the noise, focus on properties you’d be comfortable living in for the next 10 to 15 years. Take Rockwell Center, for example—a compact community that many retirees choose to call home, which helps keep demand and prices steadily rising. That mindset naturally extends your investment horizon. As Charlie Munger once taught Warren Buffett, you don’t always have to find great companies at fantastic prices—it can also make sense to buy good companies at fair prices. The same logic applies to real estate.

What does this mean for Brokers?

Buckle up—the next few years will be challenging. If possible, trim your operating expenses to stay lean. Focus your efforts on serious end-user buyers and sellers who are realistic about pricing and open to your advice when you recommend a reduction. Working with motivated, pragmatic clients will be key to staying productive in a slower market.

[1] Based on JPRE Survey of brokers and transactions, 1H2025.

[2] Transaction data gathered from JPRE broker network, 1H2025.

[3] JPRE analysis of BGC resale transactions, 1H2025.

[4] Market checks on high-end subdivision build-and-sell projects, South Metro Manila, Aug 2025 (anecdotal).

[5] Bureau of the Treasury, Retail Treasury Bond Auction Results, Aug 15, 2025.

[6] Bangko Sentral ng Pilipinas data, June 2025.

[7] Department of Finance briefing notes on RPVARA, 2025.

[8] Industry reports and broker market checks, Aug 2025.

_edited_.png)